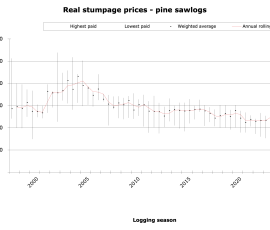

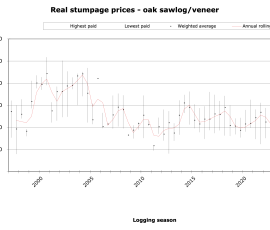

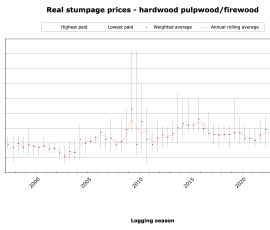

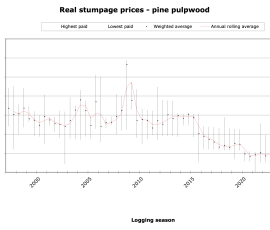

Prices for stumpage sold by Two Trees Forestry as of December, 2025

These charts document stumpage that Two Trees Forestry has sold, with prices adjusted for inflation, since May 1997 in Maine, within the area roughly bounded by New Hampshire to the west, US Route 2 to the north, Belfast to the east, and Portland to the south. Several variables contribute to the range that contractors pay during any season including differences in their access to markets, logging costs, volumes harvested and whether we sold them the timber through an auction.

December 2025

Challenging! An abrupt winter’s end, wet spring and early summer, and strict delivery quotas at the pulp and sawmills made for a particularly difficult environment for selling timber this year. Though we’ve sold significantly less timber, 67% by volume, than we did in 2024, we were able to increase the wood’s value, per cord, by a few percentage points. Many times this year mills closed off deliveries, including Hammond Lumber in Belgrade from late July into September. The SAPPI pulp mill in Skowhegan suffered numerous short-duration delivery curtailments, as a result of mechanical problems, including a large fire. The Irving mill in Dixfield, accepted only one load each week per contractor for most of the year and then dealt with a large fire. The demand for, and preferred species of, pulpwood at ND Paper’s mill in Rumford oscillated somewhat wildly. As we go into winter most mills carry significant, and seasonally unusual, inventories of logs and pulpwood. We expect that demand for wood will remain low. Fortunately, we’ve also seen that F&W’s market clout can help us improve access to some of our local mills. In any case, we strive to move forward, support local logging contractors, and help clients achieve their management and income goals.